In late January, Forbes published its annual list of America’s twenty fastest-growing cities. The magazine’s metrics include population, job, and gross production growth rates for metro areas along with unemployment and salary data. Lists like these are of interest not just to Forbes’s target audience of companies and young professionals looking to relocate, but also to researchers and others trying to understand the role of cities and innovation in the American economy. Much is known about why so many American cities declined in the post-World War II years. A bigger mystery is why some of those cities have come roaring back while others have not.

The cities that made the Forbes list were not very surprising. They were more or less the same names you’ll find on similar “hot cities” lists published by other media outlets, such as Bloomberg and Money magazine: Houston, Raleigh, Denver, Phoenix, Salt Lake City, Nashville, and so on.

Like other publications, Forbes took a stab at trying to explain why certain cities made it onto their list. It noted that the fracking-based oil and gas boom helped put five Texas cities in the top twenty, while thriving tech sectors explained why Seattle and the three California cities made the cut.

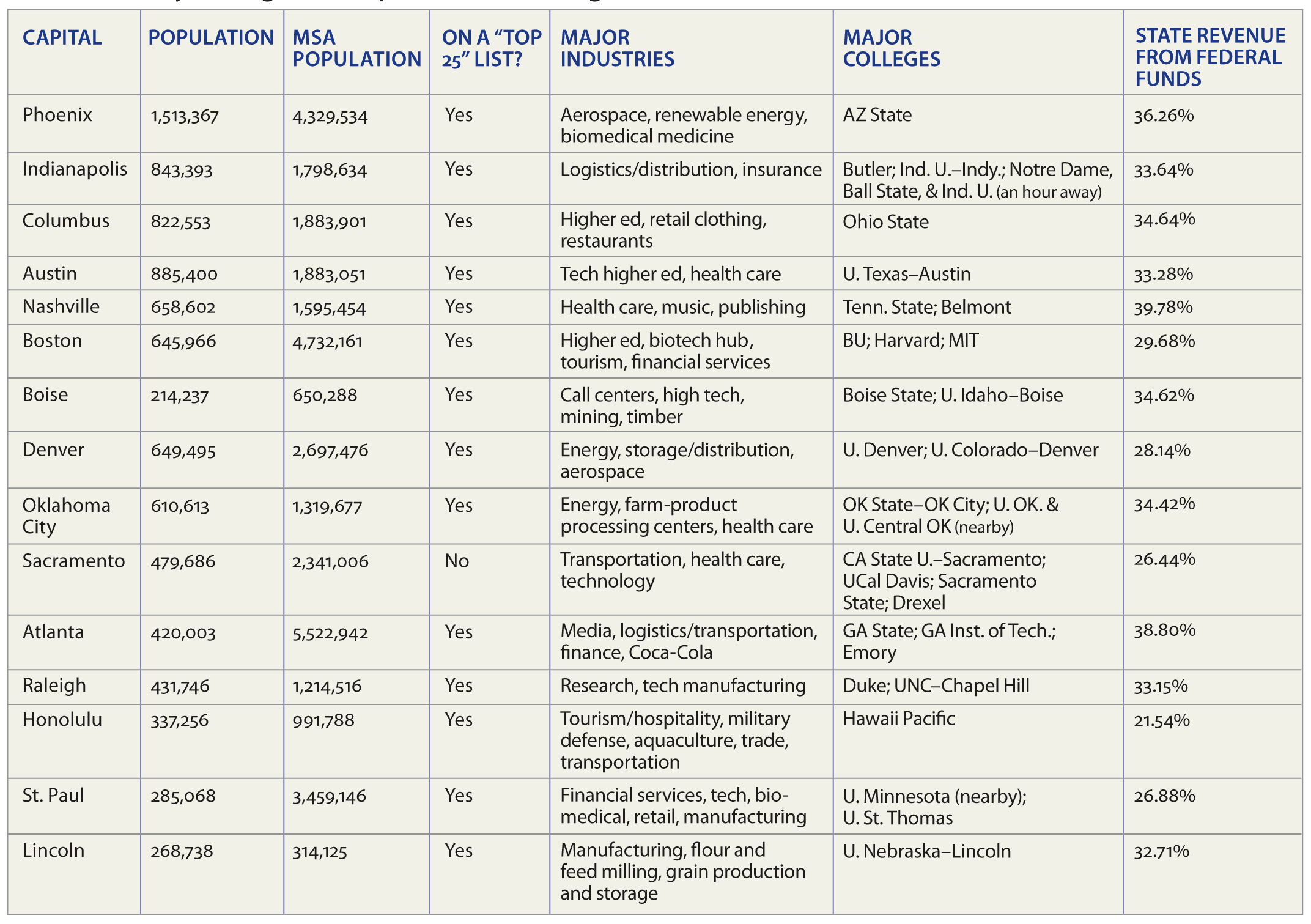

One commonality, however, that the editors of Forbes apparently did not notice is that more than a third of the cities on their list are state capitals (see Table 1). This was not a one-time lapse: cities that are home to their state’s governments have been overrepresented on Forbes’s and other media-generated lists for years, without, as far as I can tell, any of these publications ever mentioning the fact. The stories that accompany these lists typically include quotes from economists and economic development experts who try to make sense of the numbers. Factors such as tax rates, regulatory burdens, region, education levels, venture capital investment, housing prices, the existence of top-tier universities, proximity to seashores and mountains, and the percentage of workers who are in “creative” fields are usually discussed. But the idea that being home to a state’s politicians, lobbyists, bureaucrats, and tens of billions of dollars in tax revenues might give a city a significant advantage in garnering wider economic growth seems to be not widely held, nor even considered.

Which is weird when you think about it. After all, when Washington, D.C., makes it onto these kinds of lists, the first thing people say is, Well, of course it’s booming, thanks to all the government money flowing through it. State capitals don’t command as much tax revenue, obviously, as Washington does. But why shouldn’t the same basic connection—between being the seat of government and enjoying robust economic growth—apply?

In fact, it does apply, almost without fail. To be sure, not every city that is booming is a state capital. Nor is every city that is a state capital booming. Plenty of small capitals (Lansing, Michigan, and Jefferson City, Missouri, to name two) are in the doldrums. But as Table 2 shows, all but one of America’s eighteen medium to large state capitals—those with a municipal population greater than 250,000 (except for Boise, with 214,00) and a metro-wide population greater than 300,000—are flourishing economically. The only exception is Sacramento, which is in California’s Central Valley, the epicenter of the 2008 collapse of real estate prices (before that, it was booming). These seventeen cities are hubs not just, or even mostly, of government but also of entrepreneurial innovation in fields ranging from biotech to finance, aquiculture to health care.

Correlation, as they say, is not causality. I can’t prove that the presence of state governments is the reason these cities are doing well. But seventeen out of eighteen is a lot of correlation! So it’s certainly worth speculating what the causality might be. I can think of several reasons, many of them overlapping, none of them wholly satisfying.

The first I’ve alluded to. Cities that are state capitals exist, in part, to collect, process, and redistribute tax revenues. A percentage of that money goes to pay the salaries of elected officials, government employees, and contractors. Meanwhile, additional funds flow in from private entities (corporations, trade associations, unions) hoping to influence government decisions—money that supports the salaries of lobbyists, consultants, dry cleaners, steak house waiters, and so on.

But while this importation of other people’s money is certainly a factor, it’s not enough of an explanation. Otherwise, smaller state capitals, especially those in big, populous states like New York and Florida that are awash in tax and lobbying revenues, ought to be thriving too. In reality, places like Albany and Tallahassee are economic backwaters where (not to put too fine a point on it) almost nobody chooses to live if they don’t have to.

* State capital~ While Cambridge is not a capital, it enjoys many of the same benefits, thanks to its proximity to Boston

A second explanation is that state capitals never relied as heavily as many other cities did on manufacturing, and so weathered better the deindustrialization process. This certainly seems to be the case for many booming state capitals in Table 2—Raleigh, Denver, Austin, and so on. Still, several now-thriving state capitals, such as Boston, Columbus, and Indianapolis, were dependent on manufacturing into the 1950s and beyond, and suffered major declines in the 1960s through the 1980s before bouncing back.

A third explanation, a more nuanced version of the first two, was suggested to me by the Governing magazine contributing editor and author Alan Ehrenhalt and has to do with downtowns. It’s a truism in economic development circles (David Rusk’s research best shows it) that metro areas with blighted, lifeless downtowns tend not to grow as robustly as those with downtowns that have retained or gained jobs and residents. In state capitals, the centers of government—the legislative buildings, the governor’s mansion, the major agencies, and the buildings where lobbyists and contracting companies have their offices—are almost always located in or near their downtowns. What may have happened is that during the second half of the twentieth century, when so many downtown areas were emptying out, downtowns in state capitals retained a certain amount of vitality. This had an effect not unlike what happens when an anchor retailer signs a long-term lease in a mall: the government sector brings enough predictable foot traffic and economic activity that other economic actors (large and small companies and real estate investors, for example) feel comfortable investing in or near the downtowns too. It’s a plausible theory, and sounds true to me, but it’s worth noting that at least one city in Table 2 defies the theory: Phoenix, which until recently had no downtown to speak of.

This hardly exhausts the scope of possible explanations for why nearly every medium to large state capital in America is thriving. Maybe it has to do, in part, with a city’s political leaders being able to rub elbows with the state’s political leaders and using that clout to entice companies and secure advantageous policies. Perhaps it has to do with public transparency: until quite recently, newspapers in state capitals provided some of the best coverage of both state and municipal government. And there may be a connection between the knowledge-based skills and operations associated with state government and the information- and technology-based industries that have transformed the American urban landscape. There are certainly more possible explanations. Only serious research could determine which best explain the phenomenon.

If so many observers have missed the obvious-when-you-think-about-it connection between state capitals and economic growth, it may be because it’s not, at first glance, a terribly useful observation. It’s not as if struggling cities have the option of moving their state capitals there (though, on reflection, that may not be a bad idea).

But a perhaps more practical lesson to be drawn is suggested in the column in Table 2 labeled “State Revenue from Federal Funds.” It shows that somewhere between a quarter and a third of the tax dollars that flow through state capitals comes from Washington. In other words, these hot, hip havens of high tech—the Austins and Denvers, Bostons and Boises—are being significantly propped up with federal funds. And that’s just the straight government part. As the column labeled “major universities” shows, these cities are also home to centers of higher learning, which receive billions of dollars in research grants and student aid from the federal government. One could add another column on hospitals to make the same point.

Whenever a discussion arises about federal money being used to help spur specific areas of economic growth, a cry goes up from politicians and commentators across the land that Washington shouldn’t be “picking winners and losers.” But in effect that’s what’s happening with our cities. Some, by virtue of being the seats of state government, have a pipeline to federal dollars that other cities can only dream of. And that pipeline may determine which American cities thrive and which don’t.

Should leveling the playing field be a goal of public policy? If so, how might that be achieved? The obvious conservative answer would be to cut federal spending across the board—though how that would lead to more thriving cities is hard to see. The obvious liberal answer would be to spend more federal money on the cities that are not state capitals. But spending for what? After all, expensive federal programs, like urban renewal, the building of the interstate highway system, and mortgage and infrastructure policies that favored suburban growth, helped destroy American cities in the first place.

While I can’t pretend to have the answers, some experiences I recently had in my hometown of St. Louis might at least suggest a way forward. I was there visiting a half-dozen start-up firms in the nascent but growing biotech and agtech sectors of that city, which hitherto has not been know as a start-up haven. One company was attempting, through genetic engineering, to transform a common weed with highly oily seeds into a crop that farmers could plant and harvest between rotations of soybeans and corn and thus produce environmentally friendly biofuels without displacing other food crops. Another had devised a way to regrow cartilage in human joints and was in Phase II trials with the FDA. Yet another was providing quick-turnaround genomic testing to pharmaceutical companies to speed the drug discovery and development process. I came away thinking that all of these companies have the potential not only to help mankind but also to grow into sizable enterprises employing hundreds of St. Louisans.

But another commonality I discovered is this: each of these firms would simply not exist without the federal government. I mean that not in the way that Massachusetts Senator Elizabeth Warren made famous—that they benefited historically from federally funded roads, police protection, and other common provisions of government. I mean that much of their start-up money came in the form of federal grants—from the National Institutes of Health, the National Science Foundation, and other agencies. The specific high-level training of the founders was paid for by the federal government. The nonprofit lab facilities they rented at far below cost were subsidized by federal grants. The equipment in their labs was paid for by federal tax credits that flowed through the city’s economic development office. The money they took in from clients and customers came, in part, from federal grants. It was unquestionably private enterprise, and yet the vast bulk of it was underwritten by the federal government.

These are anecdotal observations, and they may mean nothing. But I can’t help shake the idea that I was glimpsing something important about the nature of innovation, entrepreneurship, and city revival in America right now: that all three are dependent, to a far greater extent than most of us appreciate and many don’t want to admit, on generous research and other funding from Washington. If we want struggling cities to have the same chance to thrive as state capitals, a lot more such federal spending may be the only way to make it happen.

*A version of this story was written for the Kauffman Foundation’s New Entrepreneurial Growth conference held in June, 2015.