It is becoming increasingly clear that Democrats are the party of ideas. While Republicans have nothing to offer but lies that are designed to exploit fear, the other side of the aisle is having a robust discussion about college affordability, universal access to health care, and various other supports for working Americans.

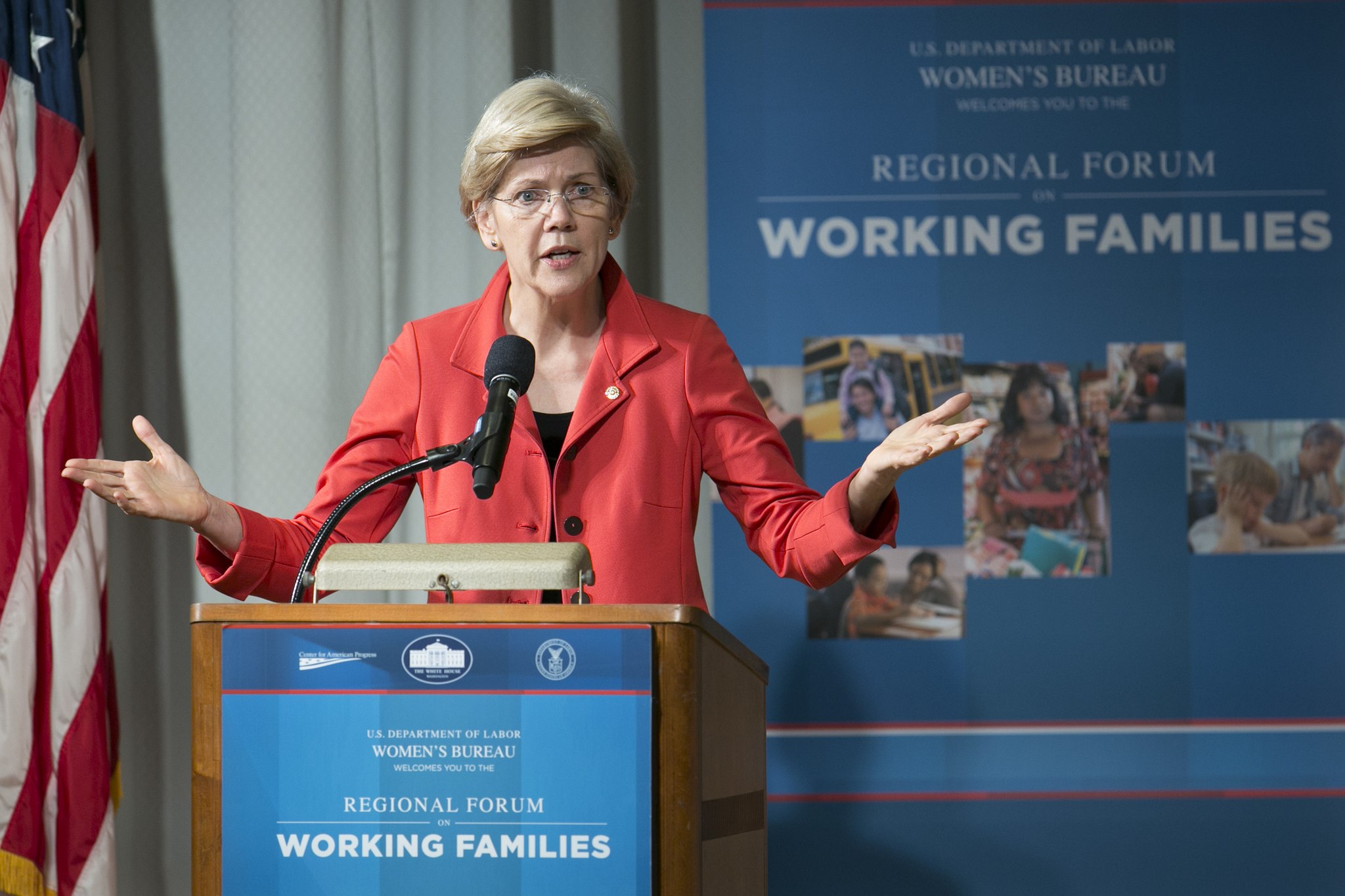

Nowhere is that discussion more evident than in various proposals being floated for tax reform. Sen. Elizabeth Warren has proposed a wealth tax, Rep. Alexandria Ocasio-Cortez floated the idea of returning to a top marginal tax rate of 70 percent, and Sen. Kamala Harris has introduced plans to lower taxes on the middle class.

It is the contrast between what has been proposed by Warren and Ocasio-Cortez that has fueled an important conversation among Democrats. For example, Warren’s plan is most interesting in that, while it raises some questions in terms of constitutionality, it addresses the fact that at the top end of income distribution in this country right now, taxes for the most wealthy aren’t affected by marginal rates because their wealth is in assets. That makes for an interesting discussion about what is the best way forward.

However, both of these ideas have sparked a more foundational question: what is the goal of taxation? I would suggest that, for most Americans, it is to provide the funds necessary for our government to function and provide for the needs of its people. But in an age of obscene income inequality, there are those who are making the case that taxing the wealthy is an end in and of itself. The extremes of those two positions were articulated by Noah Smith.

A good illustration of left-populism vs. social democracy.

For left-populism, the important thing is that rich people have less.

For social democracy, the important thing is that poor and middle-class people have more.

It’s a big difference in emphasis. https://t.co/K04sQ9e4yM

— Noah Smith ? (@Noahpinion) January 25, 2019

The discussion that follows on Twitter is illustrative of his point. For example, there are responses like this:

Seems like a distinction without a difference to me. The way you “compress” something is you squeeze from both sides. I want rich people to have less (but still more than the middle class) AND I want poor people to have more. No one wants rich people’s money to “vanish.”

But there are also those who might not necessarily want rich people’s money to “vanish,” but see value in simply reducing their wealth.

Part of the appeal of Left populism is that it attempts to address and capitalizes on the outrage people feel at the outsized political power that extremely wealthy people have in our system. Redistributive policies need to also address the distribution of power.

The argument here is that economic power equals political power, and for democracy to work, that power must be curtailed. In an interesting twist, that argument fails to take into account the depth of income inequality. To use Warren’s proposal as an example, does anyone really think that taxing billionaires at 2-3 percent of their wealth will curb either their economic or political power? If not, then how far are we willing to go to achieve that goal?

Focusing on Ocasio-Cortez’s suggestion of raising the top marginal tax rate, Vanessa Williamson makes the case that taxing the wealthy isn’t about revenue.

The purpose of high tax rates on the rich is the reduction of vast fortunes that give a handful of people a level of power incompatible with democracy…

The problem with using revenue to justify progressive taxation is that over time, an effective progressive tax system should actually raise less and less money.

Progressive taxation should work as a corrective tax, like tobacco taxes or a carbon tax. Sure, tobacco taxes raise some revenue for the states. But their primary purpose is to curb smoking. While a carbon tax could produce a lot of government revenue, the real point is to limit global warming pollution. In essence, corrective taxes try to put themselves out of business; if tobacco tax revenues decline because people quit smoking, or if carbon taxes stop rolling in because the economy becomes fossil-free, that is victory, not defeat.

Taxes on the wealthy discourage a different societal ill: exploitative capitalism.

Williamson goes on to make the case that if corporations and CEOs no longer see the benefit of enormously high salaries, they will invest their resources in more productive arenas. While her arguments about a corrective tax are appealing, you can count me as someone who is hugely skeptical of that conclusion.

Beyond the academic arguments, there is a reason why these ideas are gaining political currency. As Max Fisher pointed out, populism requires the identification of a villain in an “us against them” battle. In an age of growing income inequality, the uber wealthy make a good target.

Meanwhile, Republican messaging aimed at discrediting the role of government programs to support poor and working class Americans has made it more difficult to make the argument that government can effectively intervene to address income inequality. Large swaths of voters have been convinced that the benefits will simply go to “those people.” Consequently, some Democrats have hesitated to make the argument that taxing the wealthy is necessary in order to help those who are struggling, particularly the poor.

I would suggest that all of these issues—both the academic and the political—are important for Democrats to discuss. Any attempt to actually implement these kinds of proposals will be met with massive resistance from Republicans, so Democrats will need to have addressed these foundational questions in order to prevail.